Property Tax Rate In San Rafael . in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. this field is for validation purposes and should be left unchanged. Pay online now » you will be redirected to our secure online payment provider. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was slightly more. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting.

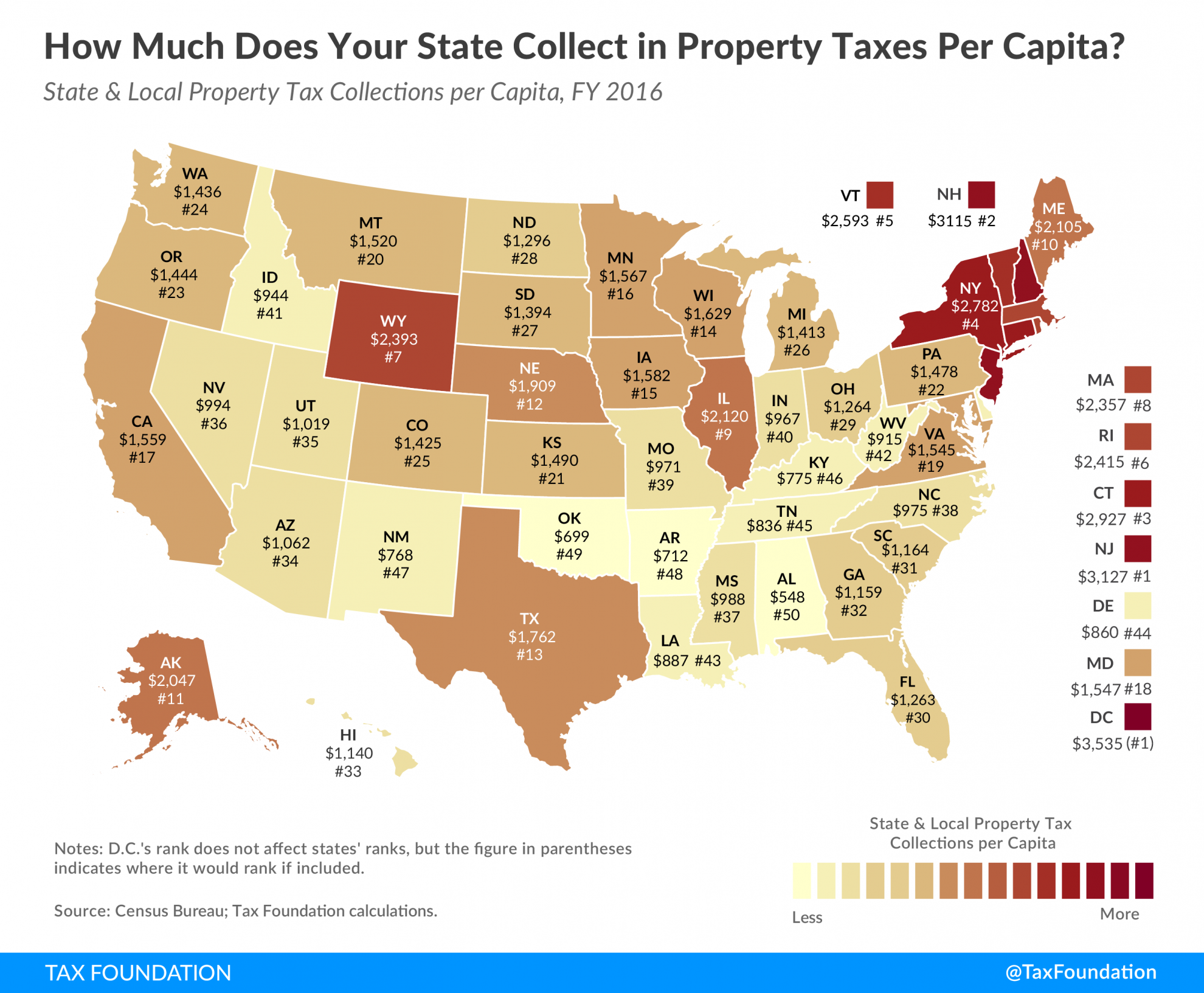

from taxfoundation.org

the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. this field is for validation purposes and should be left unchanged. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was slightly more. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. Pay online now » you will be redirected to our secure online payment provider.

Property Taxes Per Capita State and Local Property Tax Collections

Property Tax Rate In San Rafael the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. Pay online now » you will be redirected to our secure online payment provider. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. this field is for validation purposes and should be left unchanged. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was slightly more.

From bekinsmovingservices.com

San Francisco Property Tax 🎯 2024 Ultimate Guide to SF Property Tax Property Tax Rate In San Rafael Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. this field is for validation purposes and should be left unchanged. Pay online now » you will be redirected to our secure online payment provider. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22. Property Tax Rate In San Rafael.

From www.shenehon.com

Real Estate Taxes Calculation, Methodology and Trends Shenehon Property Tax Rate In San Rafael Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. this field is for validation purposes and should be left unchanged. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. Pay online now » you will be redirected to our secure. Property Tax Rate In San Rafael.

From www.fraxtor.com

How would the revised property tax rates affect the housing market Property Tax Rate In San Rafael in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. . Property Tax Rate In San Rafael.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rate In San Rafael in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. this field is for validation purposes and should be left unchanged. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was slightly more. Property taxes in. Property Tax Rate In San Rafael.

From issuu.com

PROPERTY TAX CALCULATOR by Cutmytaxes Issuu Property Tax Rate In San Rafael the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. Pay. Property Tax Rate In San Rafael.

From www.lao.ca.gov

Understanding California’s Property Taxes Property Tax Rate In San Rafael the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was slightly more. this field is for validation purposes and should be left unchanged. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. Pay online now. Property Tax Rate In San Rafael.

From taxwalls.blogspot.com

How To Calculate Real Estate Tax Deduction Tax Walls Property Tax Rate In San Rafael this field is for validation purposes and should be left unchanged. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. Pay online now » you will be redirected to our secure online payment provider. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22. Property Tax Rate In San Rafael.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate In San Rafael Pay online now » you will be redirected to our secure online payment provider. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. this field is for validation purposes and should be left unchanged. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening. Property Tax Rate In San Rafael.

From newventureescrow.com

How to Calculate Property Tax Everything You Need to Know New Property Tax Rate In San Rafael Pay online now » you will be redirected to our secure online payment provider. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. this field is for validation purposes and should. Property Tax Rate In San Rafael.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate In San Rafael the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. Pay online now » you will be redirected to our secure online payment provider. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. the city of. Property Tax Rate In San Rafael.

From www.attomdata.com

Total Property Taxes Up 4 Percent Across U.S. In 2022 ATTOM Property Tax Rate In San Rafael the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was slightly more. Pay online now » you will be redirected to our secure online payment provider. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. in 2016,. Property Tax Rate In San Rafael.

From www.newbraunfels.gov

Tax Information New Braunfels, TX Official site Property Tax Rate In San Rafael Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. this field is for validation purposes and should be left unchanged. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was slightly more. Pay online now » you will be redirected. Property Tax Rate In San Rafael.

From www.cerescourier.com

Company rates Stanislaus County in top 10 where property taxes go Property Tax Rate In San Rafael the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. this field is for validation purposes and should be left unchanged. Property taxes in san rafael usually. Property Tax Rate In San Rafael.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Rate In San Rafael Pay online now » you will be redirected to our secure online payment provider. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. the city of san rafael experienced. Property Tax Rate In San Rafael.

From realwealth.com

How to Calculate Capital Gains Tax on Real Estate Investment Property Property Tax Rate In San Rafael Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was. Property Tax Rate In San Rafael.

From exozpurop.blob.core.windows.net

Property Tax Differences Between States at Alfredo Nowak blog Property Tax Rate In San Rafael in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax. Property Tax Rate In San Rafael.

From www.eastsanfranciscohomes.com

Who Pays For What In A Real Estate Escrow Transaction You've Real Property Tax Rate In San Rafael this field is for validation purposes and should be left unchanged. the median property tax rate in san rafael, ca, is 1.43%, considerably higher than both the national median of. Property taxes in san rafael usually range between $5,400 and $16,900, with the average tax bill sitting. Pay online now » you will be redirected to our secure. Property Tax Rate In San Rafael.

From alamoadvalorem.com

San Antonio Property Tax Rates and Tax Exemptions 2023 Property Tax Rate In San Rafael Pay online now » you will be redirected to our secure online payment provider. in 2016, san rafael voters renewed a $59/year parcel tax to fund opening hours and services for the san rafael public. the city of san rafael experienced a net taxable value increase of 4.4% for the 2021/22 tax roll, that was slightly more. Property. Property Tax Rate In San Rafael.